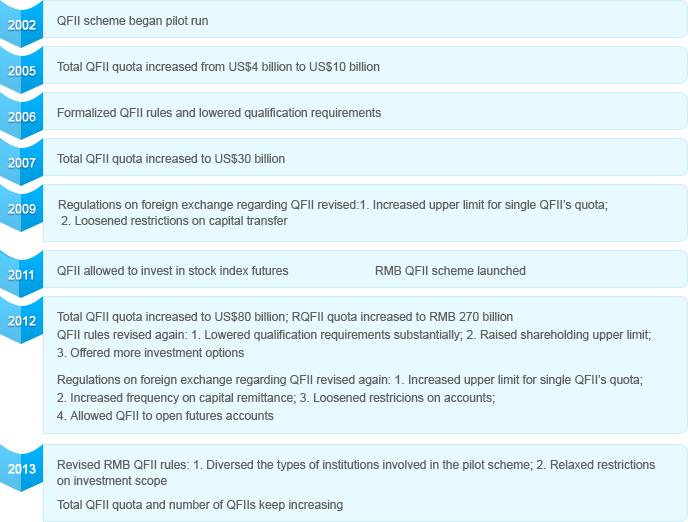

Brief History of QFII Scheme

Foreign investments in China were restricted due to foreign exchange control. In 2002, China Securities Regulatory Commission (CSRC) and the People's Bank of China (PBOC) jointly issued the Provisional Measures on Administration of Domestic Securities Investment of Qualified Foreign Institutional Investors, initiating the pilot QFII scheme, allowing foreign investors to enter China's capital market directly. QFII refers to Qualified Foreign Institutional Investors, including asset management companies, insurance companies, securities firms, commercial banks, and others such as pension funds, charity foundations, endowment funds, sovereign wealth funds.

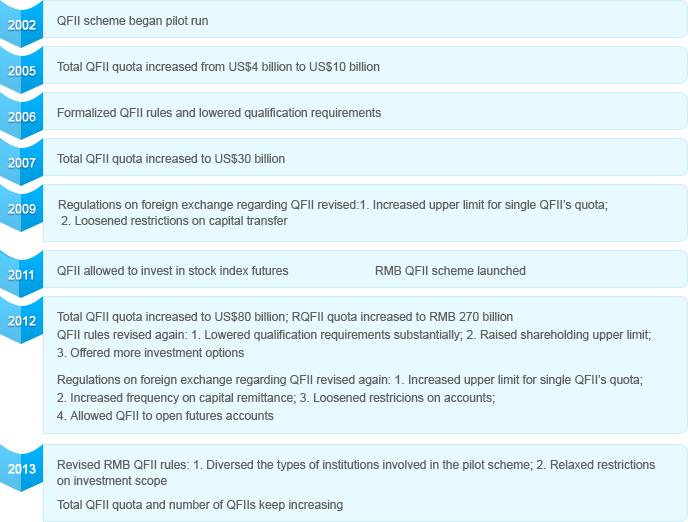

QFII Scheme Milestones

Characteristics of QFII’s Investment

Positive Impact on China’s Capital Market

QFII Requirements

1. Reputable and financially sound with a solid team of qualified professionals;

2. No record of disciplinary action imposed by regulators in the last three years;

3. Memorandum of Understanding signed between the applicant’s securities regulator and CSRC;

4. Other requirements such as operating history and asset under management

Options and Restrictions

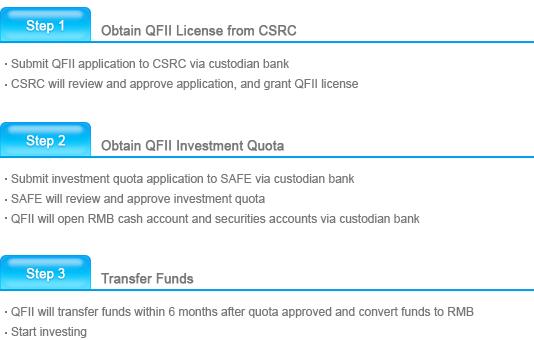

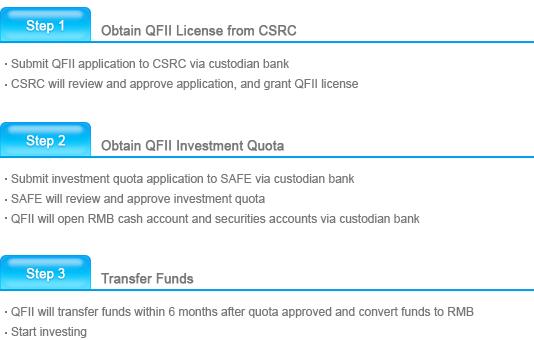

QFII Application

QFII Service Providers Custodian Banks

Custodian Banks

1. QFII should designate a custodian bank in China who safeguards QFII's asset and conducts securities as well as cash settlement

2. Custodian bank is also responsible for submitting QFII license and quota application, opening accounts and arranging fund remittance for QFII

3. Custodian bank will report material changes on behalf of QFII to regulator and update regulation changes and developments to QFII

Investment advisor/sub-managers

1. As of end of 2011, 32 QFII use external investment advisors with 13 full discretionary and 19 advisory mandates

2. 24 advisors are Chinese domestic institutions, 9 are foreign institutions

3. Among the Chinese advisors, 17 are mutual fund companies, 3 are insurance companies, and 4 are private fund management companies

Brokers

1. Each QFII can mandate multiple brokers in Shanghai and Shenzhen Stock Exchange respectively, for securities brokerage services

2. Brokers will provide trade execution, investment advice, research, corporate actions, etc.

3. 22 domestic brokers are active in servicing QFII investors in China

|

Relevant Rules & Regulations

|

|

Publish organization

|

Reference

number

|

Publish date

|

Rules & regulations

|

|

CSRC,

PBOC,

SAFE

|

CSRC,PBOC,SAFE Decree No.36

|

2006-08-24

|

Administrative Measures on Domestic Securities Investments by Qualified Foreign Institutional Investors (《合格境外机构投资者境内证券投资管理办法》)

|

|

CSRC

|

CSRC

Announcement

[2012]No.17

|

2012-07-27

|

Provisions on Issues in Relation to the Implementation of the Administrative Measures for Domestic Securities Investment by Qualified Foreign Institutional Investors (《关于实施<合格境外机构投资者境内证券投资管理办法>有关问题的规定》)

|

|

CSRC

|

CSRC

Announcement

[2011]No.12

|

2011-05-04

|

Guidelines on the Participation of Qualified Foreign Institutional Investors in Stock Index Futures Trading (《合格境外机构投资者参与股指期货交易指引》)

|

|

SAFE

|

SAFE Announcement

[2016]No.1

|

2016-02-04

|

Provisions on Foreign Exchange Administration of Domestic Securities Investments by Qualified Foreign Institutional Investors(《合格境外机构投资者境内证券投资外汇管理规定》)

|

|

SZSE

|

SZSE Membership Supervision Doc

[2014]No.36

|

2014-04-25

|

Detailed Implementation Rules of the Shenzhen Stock Exchange for the Securities Trading of Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors (《深圳证券交易所合格境外机构投资者和人民币合格境外机构投资者证券交易实施细则》)

|

|

Ministry of Finance,

State Administration of Taxation

|

Caishui

[2005]No.155

|

2005-12-01

|

Notice of the Ministry of Finance and the State Administration of Taxation on the Business Tax Policies for Qualified Foreign Institutional Investors(《财政部、国家税务总局关于合格境外机构投资者营业税政策的通知》)

|

|

State Administration of Taxation

|

Guoshuihan

[2009]No.47

|

2009-01-23

|

Notice of the State Administration of Taxation on Issues Concerning the Withholding of Enterprise Income Tax on Dividends, Bonuses and Interests Paid to QFII by Chinese Resident Enterprises(《国家税务总局关于中国居民企业向QFII支付股息、红利、利息代扣代缴企业所得税有关问题的通知》)

|

|

Ministry of Finance,

State Administration of Taxation,

CSRC

|

Caishui

[2014]No.79

|

2014-10-31

|

Notice of the Ministry of Finance, the State Administration of Taxation and the China Securities Regulatory Commission on Issues Concerning Temporarily Exempting the Income Derived by QFII and RQFII from the Transfer of Stock or Any Other Equity Investment Asset in China from Enterprise Income Tax(《财政部、国家税务总局、证监会关于QFII和RQFII取得中国境内的股票等权益性投资资产转让所得暂免征收企业所得税问题的通知》)

|

|

CSRC

|

SAFE

|

|

approves QFII status

regulates onshore securities investments by QFlls

|

approves and allocates QFII investment quota

regulates QFll's onshore accounts

monitors and regulates repatriation/remittance of funds

|

Eligible QFIIs include fund management companies, securities firms, insurance companies, commercial banks, pension funds, charity endowment funds and other asset management institutions and must meet the following qualification criteria:

|

Investor

|

Years of relevant

Business Experience

|

Net Asset

|

Assets Under

Management

|

Other

Requirements

|

|

Asset Management

|

2+

|

N/A

|

No less than USD 0.5 billon

|

N/A

|

|

Insurance Companies

|

2+

|

N/A

|

No less than USD 0.5 billon

|

N/A

|

|

Security

Companies

|

5+

|

No less than

USD 0.5 billon

|

No less than USD 5 billon

|

N/A

|

|

Commercial Banks

|

10+

|

N/A

|

No less than USD 5 billion

|

Tier 1 capital

not less than

USD 0.3 billion

|

|

Other Institutional

Investors*

|

2+

|

N/A

|

No less than USD 0.5 billion

|

N/A

|

*Note: other institutional investors include pension funds, charity funds, endowment funds, trust companies, government investment management companies etc.

On Feb 4, 2016, the SAFE reissued the Provisions on Foreign Exchange Administration of Domestic Securities Investments by Qualified Foreign Institutional Investors (“New Regulation”), which came into force the same day. The New Regulation loosens restrictions of the original provisions in terms of the administration of the investment quota. Below is a summary of the quota registration system stipulated by the New Regulation.

|

Basic

Quota

(Filing basis)

|

Applicants whose assets owned or managed by it or its corporate group are primarily outside China

|

=USD 100 Million + its average asset(or AUM) scale in the last 3 years * 0.2% - the obtained RQFII quota (after being converted into USD) ;and

No less than USD 20 million; no more than USD 5 billion.

|

|

Applicants whose assets owned or managed by it or its corporate group are primarily within China

|

= Equivalent of RMB 5 billion + its asset (or AUM) scale of the preceding year * 80% - the obtained RQFII quota (after being converted into USD)

No less than USD 20 million; no more than USD 5 billion.

|

|

Sovereign funds, central banks and currency administration authorities

|

No more than USD 5 billion.

|

|

Extra Quota

(Approval basis)

|

If a QFII needs more than its basic quota, application to SAFE for approval is required

|

The filing and approval requirements stipulated in the New Regulation are also applicable to those QFIIs that have obtained the investment quotas before the promulgation of the New Regulation when such QFIIs apply for increase of their investment quotas.

QFII can repatriate the principal and profit after a lock-up period, according to the QFII rules, subject to SAFE’s approval. Details are as follows:

|

Inbound Remittance

|

If the investment quota of a QFII has not been effectively used within 1 year after the date of filing or approval, SAFE may cancel all or part of the unused investment quota

|

|

Lock-up Restriction

|

Subject to a 3 months lock-up period starting from:

the day the accumulative total investment principal remitted inbound by QFII reaches USD 20 Million

|

|

Repatriation

|

Repatriation can only be made after the expiry of the lock-up period, and:

|

|

|

Subscription and redemption of open-ended funds:

|

handled on a daily basis, however, the accumulated monthly net capital remitted by a QFII thereunder shall not exceed 20% of the fund’s total domestic assets at the end of the preceding year.

|

|

|

Others:

|

the accumulated monthly net capital outflow remitted by a QFII shall not exceed 20% of its total domestic assets at the end of the preceding year.

|

|

|

|

|